But as a founder, how do you prepare to get a seed investment? When is the best time to start looking for outside investors, and more importantly, which investors should you approach and how

We found answers to these questions and talked to the team at SeedBlink, a European co-investment platform founded in Romania, about what expectations founders should have when talking to investors who could fund their startups.

What is and what is not a startup?

A startup, as defined by Steve Blank, is "an organization founded to develop a repeatable and scalable business model."

Once the value creation model is proven and 10x growth has been achieved, that organization becomes a mature enterprise.

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Paul Graham delves deeper into the definition of a startup and equates a startup with growth itself, saying that a startup is a company that grows exponentially.

This exponential growth can, of course, be achieved by founders who have introduced products and/or product distribution through digital/Internet channels.

But to achieve exponential growth, fundraising is an important element for a startup founder.

Pre-seed investment: Founder money and support from your family

First, let us talk about pre-seed investments. They are the first type of investment a startup can access, and most often the money comes from relatives or family, in addition to the founders' own funds.

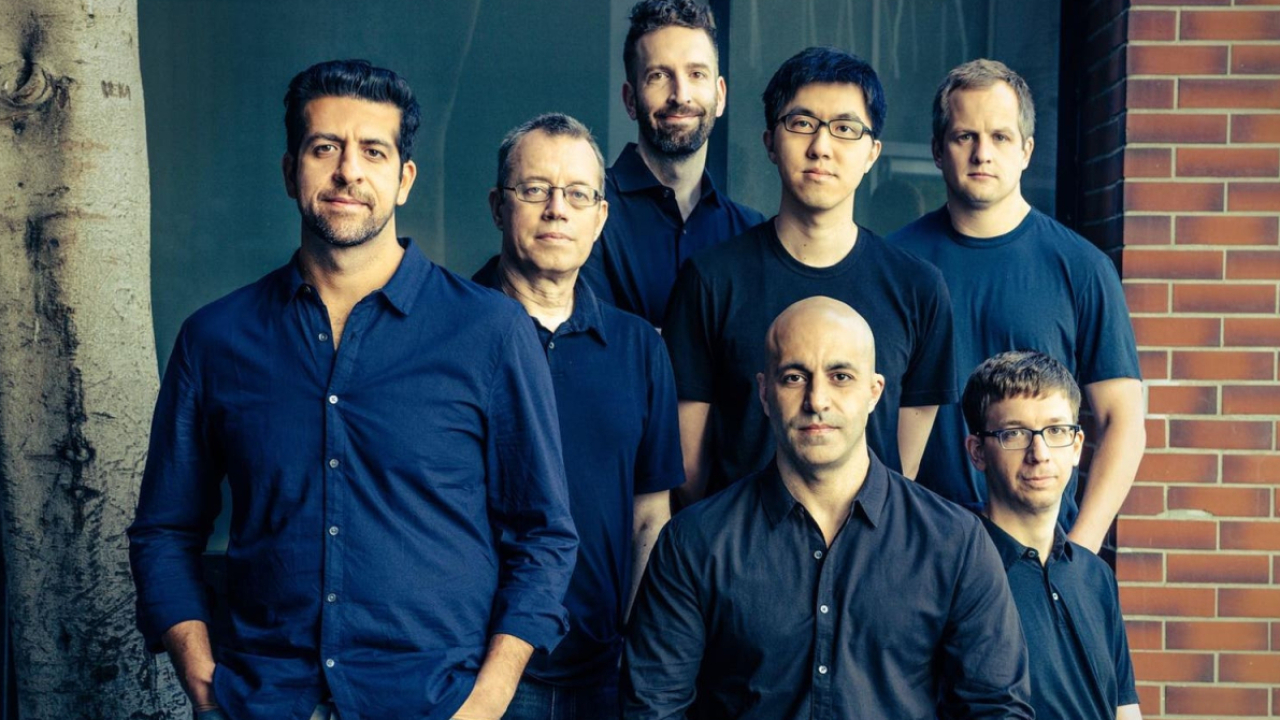

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

"It takes a village" to raise not only a child but also a company, but as a startup founder, how do you know when the time is right to approach investors outside your own circle of acquaintances for a seed investment?

The right time to look for investors

As representatives of the investment platform SeedBlink explain to us, the most favorable time for a founder to start looking for investors is when the number of months covered as operating costs is less than 12 (i.e. one year).

From their point of view, there is more information that can help you better understand if you are in an opportune moment to seek financial support from private investors or investment funds.

For example, there are some questions you can ask yourself as a founder - and ideally have clear and unambiguous answers to - when considering that you need funding: Do you already have a proven business with revenue or are you in the MVP phase? Do you already have a network of people to turn to, or are you starting from scratch?

"The seed investment should move your company from the product validation phase to the market validation phase, where you need to prove the market need for your solution."

Seed funding typically comes from private investors - also known as angel investors - or individuals, investment funds, accelerator programs and incubators who see growth potential for the company and want to contribute to its development by receiving equity in exchange for money.

Reach out to the right investors

Another point a startup founder should consider when preparing a seed investment is the type of investors you approach.

It is very important that founders make their selection based on their needs and the area in which the startup operates when approaching investment funds.

Otherwise, your efforts as a founder may be misguided if you try to convince the wrong people.

"Usually, the seed round is covered by business angels and local VCs who know better the market and the ecosystem in which you started. There are also investors who specialize in certain verticals such as HealthTech, Fintech or Edtech, and it is advisable to approach them to benefit from the expertise in this area," advise the representatives of the investment platform SeedBlink.

How do you know you have an investable project?

We come to another important point in a startup founder's decision to prepare a seed investment.

So how can you tell when you do not have an investment-ready company at the moment? More specifically, when not to seek investors and instead continue to work on consolidating the company.

Basically, if you don't have a clearly defined plan in which you have set the development path for the next 3to 5 years, nor how you are going to achieve the proposed milestones.

A pre-seed round is for a company at a very early stage. Seed rounds are for startups that have minimal proven traction, for example, a recurring monthly income of 2,000-5,000 euros, even up to 50,000 euros. They have a validated business model with a base of early adopters, but need funding to scale through sales and marketing.

"An investor can not get your company from point A to point B if you do not already know the path. At the same time, it's never easy for a founder to sell shares in their company, and there will be times when it's not necessary. If you have a plan and believe you can scale your business without the help of an investor, do not feel pressured to do so. There are unicorns that have done it without," SeedBlink executives said.

Oana Coșman

Oana Coșman