KAYA has so far mainly rooted for Czech, Polish and Slovakian startups, but as part of its new fund, one of Central Europe's oldest and most successful early-stage venture investors will invest in the broader Central and Eastern European region as well.

For companies that are on a good path to realizing their potential, the fund keeps a capital reserve for follow-on rounds and through syndication with select investors, it can allocate up to EUR 20 million to a single company.

A typical initial investment from KAYA ranges from one to three million Euro.

KAYA not only invests in technology, but also actively uses it to improve its own operations. Since 2018, it has been developing a data platform that monitors the global startup scene in real time and helps capture early signals from promising companies.

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Unicorns and a promising portfolio of companies

KAYA has two unicorns in its portfolio. In addition to the Czech Rohlik, it is the Polish Docplanner. The former is a fast-growing European e-grocer, the latter is the world's leading healthcare booking platform.

There is a soon-to-be unicorn too – Poland's Booksy, which crossed €100 million in revenue last year. Besides Better Stack by Veronika Kolejak and Juraj Masar, other hopefuls are SensibleBio by Miroslav Gasparek and Marian Kupculak, Upheal by Juraj Chrappa and Martin Horvath, TopK by Jergus Lejk and Marek Galovic, E2B by Tomas Valenta and Vaclav Mlejnsky, and Superlinked by Daniel Svonava.

Some of the other stars of the current portfolio are Jutro Medical, Yoneda Labs, and ZetaLabs. Currently, KAYA has more than forty-five companies in its portfolio, the value of its holdings in these companies amounts to EUR 350 million.

From the very beginning, KAYA did not specialize in any particular industry or business vertical.

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

"Our goal is to constantly think about the technologies and trends of the future. When we invested in Rohlik, the company was not understood and almost written off by traditional software investors, which we didn’t want to be the case for us. That's also why we are actively looking at various less traditional VC sectors, such as biotechnology, new materials, healthcare, and others. We consider ourselves 'generalists', i.e. a fund that is not tied to any specific domain. We believe that we understand the sentiment of entrepreneurs coming from CEE and we want to support them wherever in the world they may be" , says Martin Rajcan, who lives in London and works primarily with founders from CEE located outside of the region.

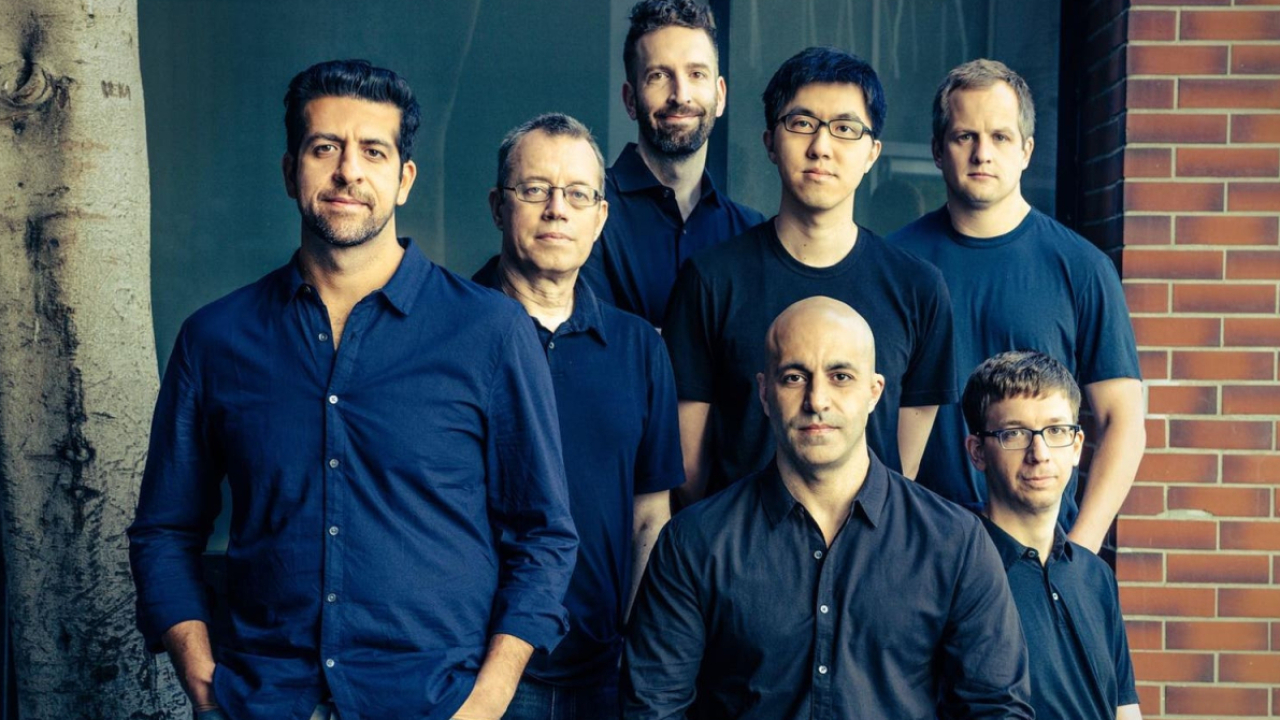

KAYA enters the new investment phase with a strengthened team. One addition to the general partnership of the fund is a former startup founder Karel Zheng, who has been with KAYA since 2018 except for a period when he ran his own startup.

"The last decade has shown that there is a growing pool of technology talent in Central and Eastern Europe that has contributed to a number of global success stories - and KAYA has been behind many of them for almost fifteen years. We look for founders with big dreams and the courage to go global, and we want to be their first partners and long-term supporters: we enter at an early stage and stay on as the company grows into a truly global, impactful company." says Tomas Obrtac, one of the four equal partners of the fund.

Young startups need help with growth and follow-on capital

Fourteen years of experience in the market taught KAYA that young companies need help in two areas in particular. The first area is access to experts who can effectively advise founders on a range of topics. KAYA offers its portfolio companies access to experts who have experience of running their own businesses or building and scaling global companies.

This network includes, for example, entrepreneur Tomas Cupr who founded first Czech unicorn Rohlik, AI expert and founder of EquiLibre Technologies Martin Schmid, Juraj Masar and Veronika Kolejak from Better Stack, Michal Valko who worked with Mark Zuckerberg on Llama 3, and Jakub Jurovych who is behind Deepnote.

The second area founders need help with is to secure follow-on investments. As the process of building relationships and trust is a lengthy one, KAYA helps investee companies accelerate discussions with funds whom it knows well and with whom it has co-invested for many years. These investors include, for example, the British-American Index Ventures, the European Creandum and Goldman Sachs, and global funds such as EQT.

Oana Coșman

Oana Coșman