The Recursive announced the release of the second edition of its State of AI in CEE Report. The report explores over 1.350 AI startups, scaleups, investors, and other ecosystem stakeholders in CEE and paints the most comprehensive picture of trends in CEE’s AI ecosystem across funding, industry and technology specialization, talent base, and regulation.

“The State of AI in CEE 2024 is the most comprehensive report exclusively focused on AI developed in CEE. As the region continues to grow, it’s encouraging to see countries collaborating to advance further innovation. Through our research and analysis, we’ve highlighted the region’s strengths and challenges—what’s working well and what needs improvement,” Elena Ghinita, Editor at The Recursive and Lead Author of the report.

In 2024, Romania’s AI innovation ecosystem saw interesting dynamics, led by FintechOS's €55.2M round. The investment amount raised so far is €28M less than in 2023 and still can surpass it. Other notable rounds are FilmChain’s €2.8M seed and Genezio’s €1.8M pre-seed.

Abundant VC Funding in the Region

There are currently about 30 VC firms whose investment thesis is focused on investing across all of CEE, including traditional regional players like Digital East Fund, Credo Ventures, OTB Ventures, EBRD VC, Endeavor Catalyst, and 500 Emerging Europe but also firms who started in Bulgaria, Poland, Romania, Hungary and with their second or third fund, they’re expanding internationally.

Across Bulgaria, Romania, Poland, Hungary, and the Czech Republic, fresh new funds launched totaling almost a billion euros, and this doesn’t count another half a billion euros the Bulgarian Fund of Funds plans to allocate to local VCs next year. Many funds across the region are still investing the money they raised between 2021 and 2023.

AI Investments in CEE Still Resilient in 2024

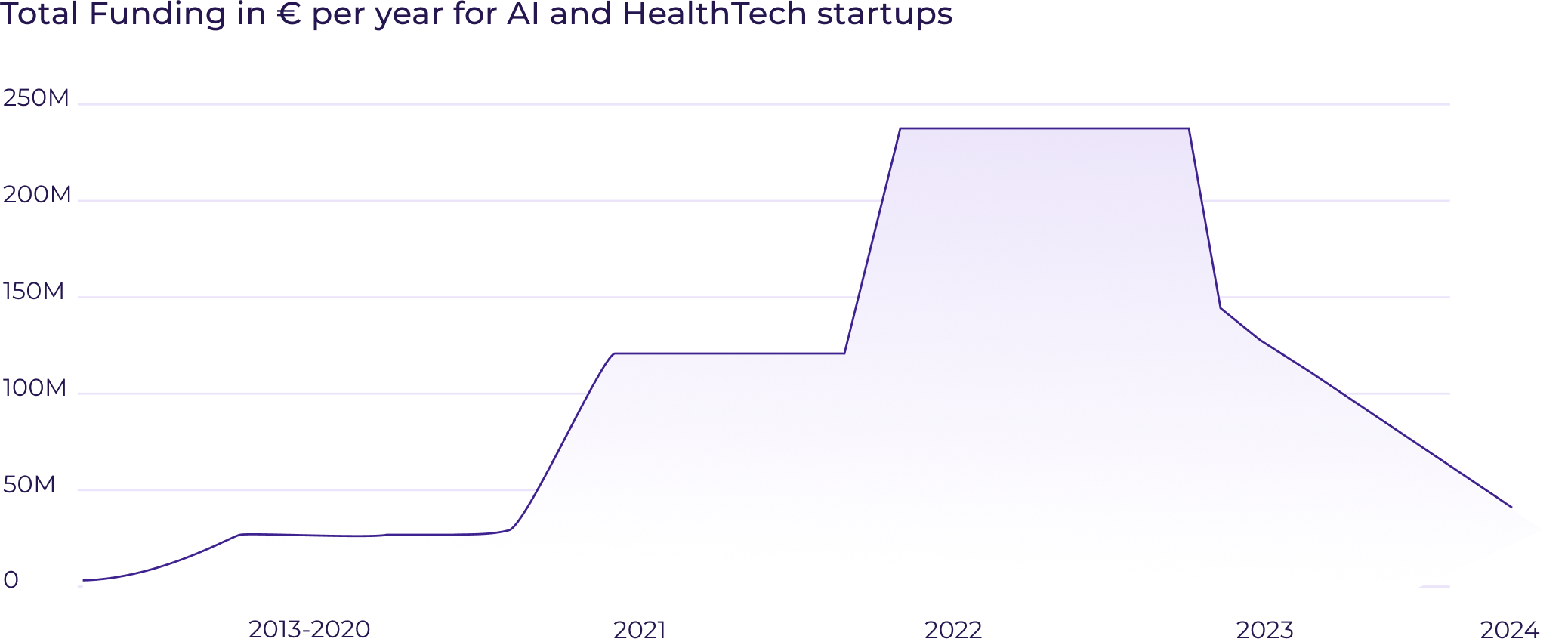

The study estimates that from the beginning of 2021 until September 2024, € 5 billion have been invested in CEE AI companies. While the general VC landscape in CEE has slowed down in the past year, investments in AI in CEE seem to be on track in 2024 (€593 million at the end of August, with at least €55 million more as of today) to at least match 2023’s €850 million.

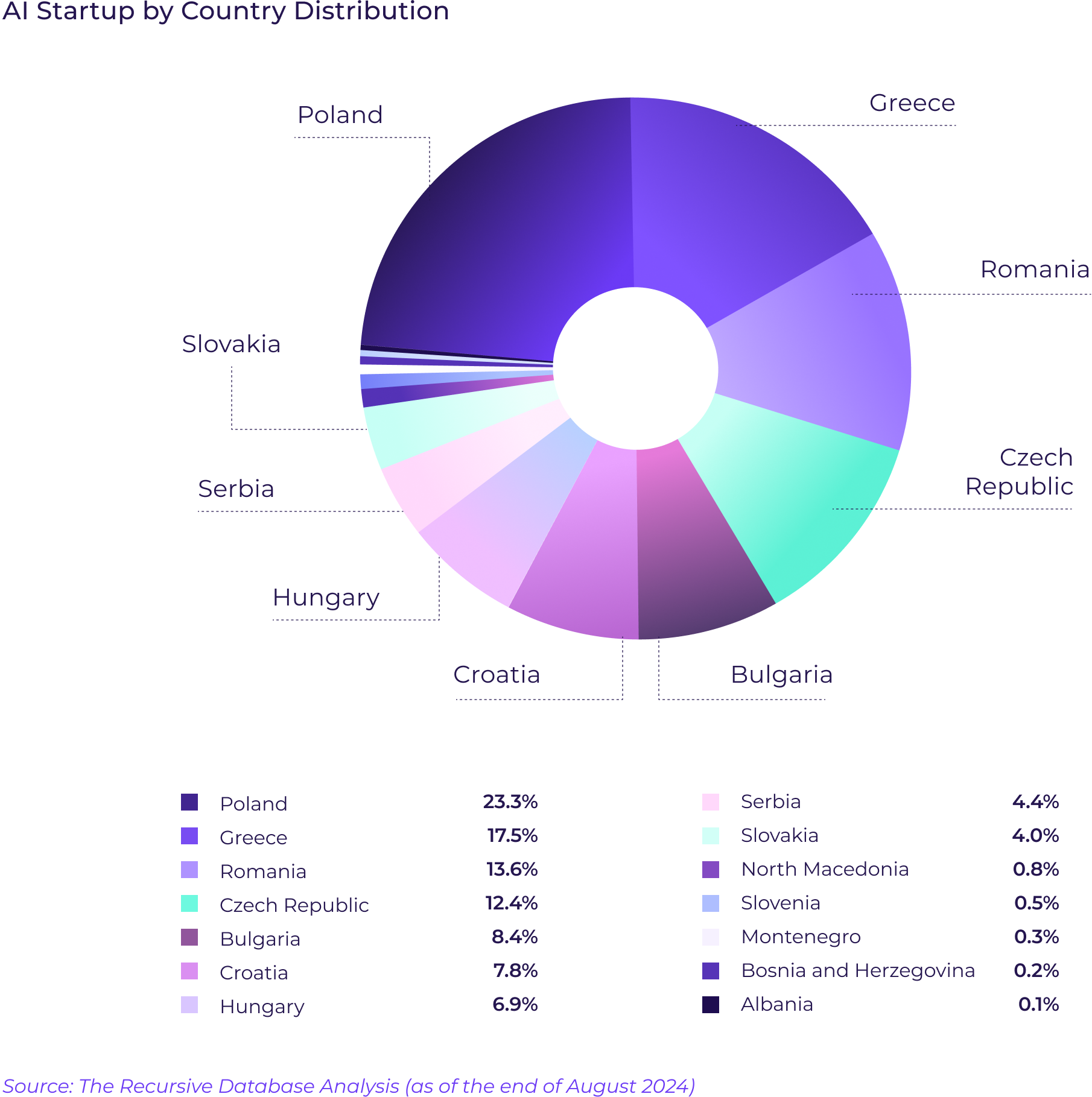

Poland, Greece, and Croatia lead the region in terms of funding attracted this year, the three countries capturing over 75% of all AI funding in the region.

Towards Vertical AI in CEE

In line with the global trend towards vertical AI, we sense the first signs of CEE’s ecosystem specialization in industry-focused solutions.

CEE companies focused on AI media production have raised +€120 million in 2024. But this was mostly driven by the later stage rounds of three companies - Eleven Labs, Colossyan, and Creatopy. At the same time, in the healthcare sector, we can see a similar amount of €120 million raised but by approximately 40 (mostly) pre-seed and seed companies.

In The Recursive survey to investors, the VCs share they see the biggest next AI opportunities exactly in healthcare but also cybersecurity and the traditionally strong CEE vertical of finance.

Why CEE Could Be the Right Move for Your AI Startup

While success stories are increasing and investor interest is strong, high-quality startup creation lags behind the available venture capital.

This is evident as more CEE-based VCs invest in diaspora founders or even in businesses outside the original investment thesis. To bridge this gap, CEE must focus on attracting global resources, networks, and talent - a goal that unfortunately remains under-prioritized by most governments in the region.

This gap and growing VC supply could attract Western founders to establish their businesses in CEE, leveraging the region’s tech talent, cost-effective environment, and resilient underdog culture.

Alexandra Rusu

Alexandra Rusu