Descoperă toate podcasturile

Pe start-up.ro poți găsi podcasturi realizate sau găzduite de către site-ul nostru. Poți vedea interviurile jurnaliștilor start-up.ro, dar să descoperi și producțiile realizate de Launch România, Make IT in Oradea, Business Room sau Fabricat în RO direct pe start-up.ro, locul ce vrea să fie piațeta virtuală de întâlnire a antreprenorilor din România.

Descoperă mai multe

The Work in Progress podcast is a Green Start-Up and start-up.ro production focused on the investors and founders that change the startup ecosystem.

We've centered the Work in Progress podcast around two major themes, and were going to split the episodes into the Blue podcast – for start-up.ro – where we'll discuss with venture capital managers, angel investors, startup founders from Romania, Europe and around the world about their role in the ecosystem, business, trends, and the Green podcast – for Green Start-Up – where we will put a sustainability layer on our discussions and we'll approach topics relevant for impact founders as well as impact investors.

Founded in 2016 and based in Athens, Greece, VentureFriends focuses primarily on pre-seed and seed-stage investments across Europe, with a portfolio spanning over 12 countries and 75 companies.

What you’ll find out from our discussion:

- VentureFriends focuses on pre-seed and seed-stage startups across Europe with a €100M fund and pan-European presence.

- Key investment sectors: Fintech, marketplace, PropTech, software services, with growing interest in AI, cybersecurity, and energy tech.

- Strong founder-investor relationships are crucial; VentureFriends acts as a supportive partner during both good times and crises.

- Founder qualities sought: resilience, complementary skills, clear vision, passion, adaptability, and the ability to attract talent.

- Common red flags include unrealistic valuations, lack of in-house tech, broken founding teams, and ignoring competition.

- VentureFriends’ differentiator is its extensive European network, hands-on approach, and readiness to invest significant capital in promising startups.

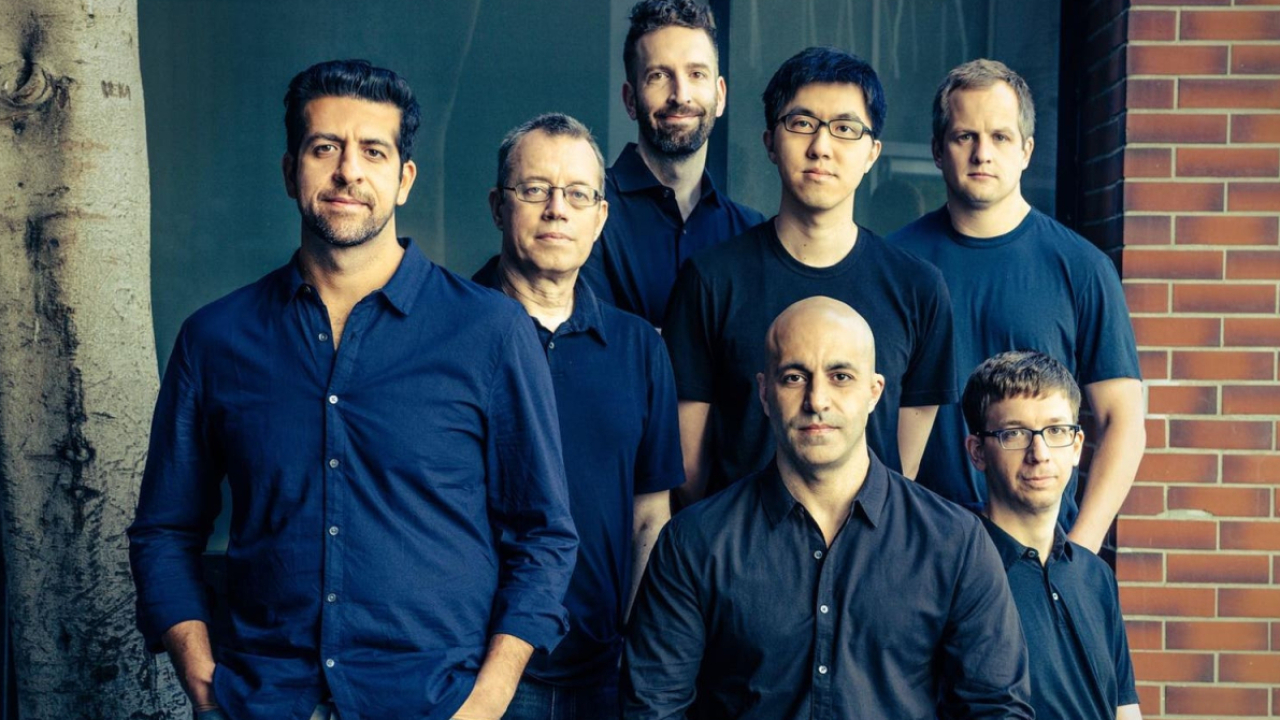

Pavlos Pavlakis is a principal at VentureFriends, joining the VC after gaining experience both in the startup and finance worlds. He was Head of Strategy & Finance at Quiqup, a London-based marketplace startup, where he led a £20m Series B funding round. He previously worked in Structuring & Transaction Execution at CapInvest in London, investing mostly in Real Estate among other asset classes from multiple funds with $500m in total AuM. Pavlos holds a BSc Mathematics and Economics degree from London School of Economics and an MSc Finance degree from Imperial College Business School.

For the Work in Progress podcast, Pavlos provided us with an in-depth look into the workings and philosophy of a leading European venture capital firm that has a motto the phrase "Investors who love startups".

Pavlos’ background as a startup operator allows him to empathize deeply with founders’ challenges and better understand what they need from investors. This dual perspective enhances VentureFriends’ ability to support startups beyond just providing capital, fostering genuine partnerships grounded in shared experience.

"In the venture capital world, you have to screen thousands of companies but invest in only a few – the difference is made in the details and deep understanding of the team and the market."

He revealed the intricacies behind venture capital beyond the glossy surface of startup hype. The firm’s deliberate focus on early-stage investments acknowledges that foundational support—financial and strategic—is what truly propels startups to the next level. Their pan-European footprint allows them to transcend local market limitations, a strategic advantage in Europe’s diverse economic landscape.

Traits of a "lovable" founder

Founder characteristics emerge as the heart of investment decisions, underscoring the venture capital truth that startups are people-driven enterprises.

The emphasis on resilience and adaptability reflects the reality that startup journeys are fraught with uncertainty and setbacks.

Pavlos also talked about some red flags that investors see in the founders and teams pitching them. These insights offer practical guidance for founders to self-assess and align expectations with market realities.

So, what to avoid when pitching investors? Unrealistic financial projections and valuations can mislead investors and stall growth. Additionally, startups lacking proprietary technology or suffering from founding team conflicts often face operational hurdles. Recognizing and addressing these red flags early can save time and resources for both investors and founders.

During our talk, Pavlos also reflected on how emerging technologies like AI are influencing the venture capital landscape. The balanced perspective on AI’s role is particularly noteworthy. While AI can streamline operational tasks like screening, it cannot substitute the nuanced human judgment needed to evaluate complex interpersonal and strategic factors. Moreover, AI’s democratizing effect on entrepreneurship intensifies competition but does not alter the fundamental criteria for success.

Finally, Pavlos gave a description of what VentureFriends’ motto “investor friends who love startups” encapsulates: long-term, empathetic partnership over transactional funding.

Key themes include the critical factors VentureFriends looks for in founders—such as resilience, complementary skill sets, clear vision, and passion—as well as common pitfalls like unrealistic valuations and unclear market positioning.

"It’s not enough to have a good idea. What matters a lot is the team, complementary skills, and the passion that keeps you awake at night thinking about your vision." He adds the fact that "resilience is key for a founder: you must be prepared to go through tough times, adapt, and be a leader who inspires."

He stresses that startups are inherently “works in progress,” and a healthy evolution is essential, but too much indecision or lack of focus can be detrimental.

The need for a disciplined approach

Other key insights from Pavlos Pavlakis:

- Founder traits over pure metrics: While market size and technology matter, Pavlos stresses that the most predictive factors for scaling startups lie in founder qualities—resilience to setbacks, passion that drives late nights, adaptability amidst uncertainty, and the ability to inspire and recruit talent. These human elements are difficult to quantify but crucial for long-term success.

- AI enhances but doesn’t replace human judgment: While AI tools can help filter and screen the sheer volume of startup pitches, the nuanced evaluation of team dynamics, founder mindset, and strategic vision still requires human insight. Pavlos believes AI lowers barriers for entrepreneurs but won’t fundamentally change the core venture capital process of identifying exceptional founders.

- Startups as ‘Work in Progress’: Pavlos embraces the idea that startups are evolving entities that must adapt and refine their strategies continuously. However, excessive indecision or lack of focus can be detrimental. The role of a VC includes helping founders strike a balance between iterative development and decisive execution, fostering sustainable growth rather than chasing unrealistic hype.

- Importance of long-term partnership: VentureFriends positions itself as a “friend” to founders, emphasizing support not just during successes but especially during tough times. This long-term commitment builds trust, encourages transparency, and often helps startups navigate crises, as evidenced by their support during the COVID-19 pandemic.

- Balanced approach to growth and valuation: Pavlos warns startups against prioritizing valuation growth at the expense of operational stability. Sustainable growth, clear market understanding, and realistic milestones often trump aggressive scaling that can lead to overvaluation and future fundraising difficulties. This disciplined approach benefits startups and investors alike.

- Psychological and human factors are key: The conversation highlights that venture capital is not just about numbers but fundamentally about people. Understanding founder psychology, motivations, and interpersonal dynamics is critical for investment decisions and subsequent relationship management.

Oana Coșman

Oana Coșman