According to the report, global venture funding in Q3 2024 totaled $66.5 billion, marking a sustained decline with a 16% drop quarter-over-quarter and 15% year-over-year. At the same time, venture funding to European startups in Q3 2024 plummeted to $10 billion, the lowest since Q3 2020, with a 36% quarter-over-quarter and 39% year-over-year decline.

A 35% drop in VC capital reveals a deepening funding vacuum

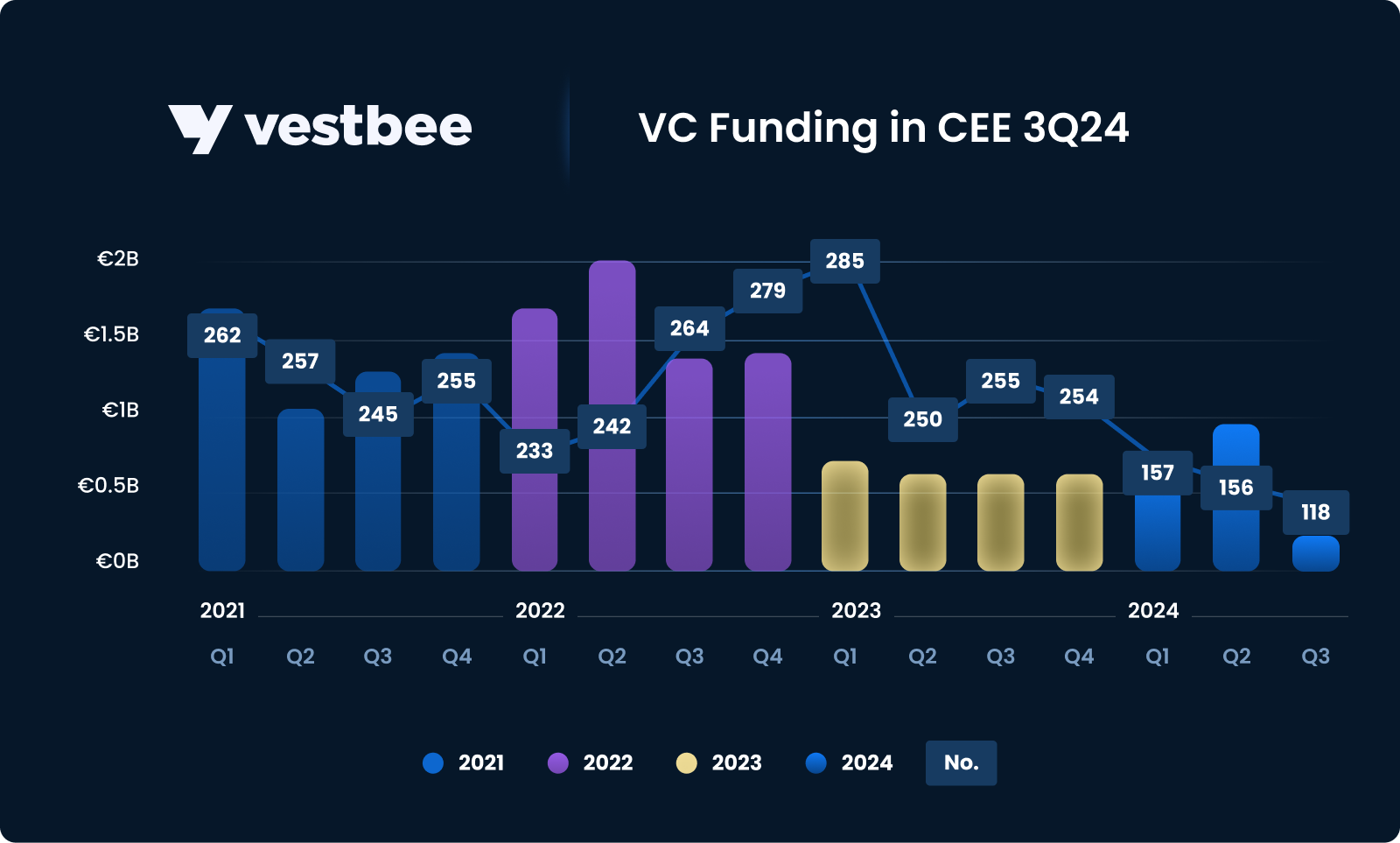

VC funding in Central and Eastern Europe hit a significant low in Q3 2024, totaling just €360 million across 118 rounds. This represents a substantial 35% year-on-year decline in capital and an even sharper 54% drop in deal count. This data shows a challenging period for the CEE startup ecosystem, mirroring broader declines observed in global (a decline of 15% YoY) and European (39%) markets.

However, even within this context, the scale of the downturn in CEE is alarming. In comparison, the previous quarter saw 2.6x more capital raised — €940 million — bolstered by Rohlik’s mega-round. This quarter lacked this huge deal, with the largest round being an €83 million Series A for Rentberry.

Ewa Chronowska, CEO of Vestbee and VC investor, highlights the critical challenges facing the CEE startup ecosystem: "The absence of mega-rounds has exposed structural vulnerabilities, particularly underscoring the region's heavy reliance on large deals and public funds to maintain momentum. Investor caution, especially towards high-risk, early-stage innovation, prolongs fundraising cycles and imposes stricter deal terms. If this trend continues, the CEE ecosystem risks losing its competitive edge, further widening the gap with more developed markets in Western Europe and beyond."

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Regional leaders and sectoral trends

Despite the challenges, Poland, Estonia, and Lithuania emerged as leaders in the CEE region, accounting for 50% of total investment activity with 45, 16, and 14 rounds, respectively. Ukraine also stood out by contributing over 20% of funding volume, thanks to Rentberry’s significant round.

Top-performing sectors included financial services, AI, SaaS, energy, Web3, biotech, and IT, reflecting sustained interest in scalable and high-growth areas despite declining activity.

The quarter’s most active regional VC funds were Early Game Ventures, SmartCap, Soulmates Ventures, FIRSTPICK, Venture to Future Fund, and Warsaw Equity Group.

New VC funds in the CEE region

Amid the downturn, new ventures emerged in the ecosystem. Budapest-based Lead Ventures launched a €100 million fund targeting late seed and Series A startups, Bulgarian BrightCap announced a €60 million fund focused on the future of work, digital health, and fintech, and Polish PFR Ventures committed €47 million to four early-stage funds, including Digital Oceans Venture.

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Global and European funding trends

The funding challenges in the CEE region reflect a broader trend of contraction in venture capital markets. Global VC funding totaled $66.5 billion in Q3 2024, marking a 16% quarter-on-quarter decline and a 15% year-on-year drop, with reduced late-stage mega-deals driving much of the slowdown.

Meanwhile, European startups raised $10 billion, the lowest quarterly total since Q3 2020, with a 36% quarter-on-quarter and 39% year-on-year reduction. As Germany showed resilience with a 33% funding increase, the broader European landscape mirrors the CEE region's struggles, characterized by shrinking late-stage investments and a pullback in early-stage activity. This underscores the urgency for targeted actions to sustain innovation and competitiveness in the continent.

Oana Coșman

Oana Coșman