The fund has already seen the commitment from private investors, accounting for over half of its total AUM, with institutional investors expected to commit by the end of the year.

The third fund will continue Inovo’s mission of identifying and nurturing outstanding founders of tech companies from the CEE region and supporting them in conquering international markets. It aims to invest in a total of 20-30 companies, with a single investment ticket ranging from EUR 500 up to EUR 4 million, from pre-seed to Series B rounds.

Inovo VC plans to invest 60% of its capital in Polish tech startups, and the remaining 40% in companies from other countries of the CEE region.

“We are looking for companies conquering global markets that can grow to USD 100 million in revenue in just a few years. We have managed to become a fund of choice for Polish founders and we want to replicate that in the other CEE countries, as we already see we can be as helpful to those founders as we are to the ones from Poland”, says Michał Rokosz, Partner at Inovo VC.

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Inovo VC is the first Polish venture capital firm to announce its third fund, following the success of the first two vehicles. They had a total capitalisation of EUR 60 million for investments in the companies from the CEE region. The first fund, in its exit phase, has already seen a 3x return of allocated capital. The second is still active, but only takes parts in the follow-on funding rounds of its existing investments.

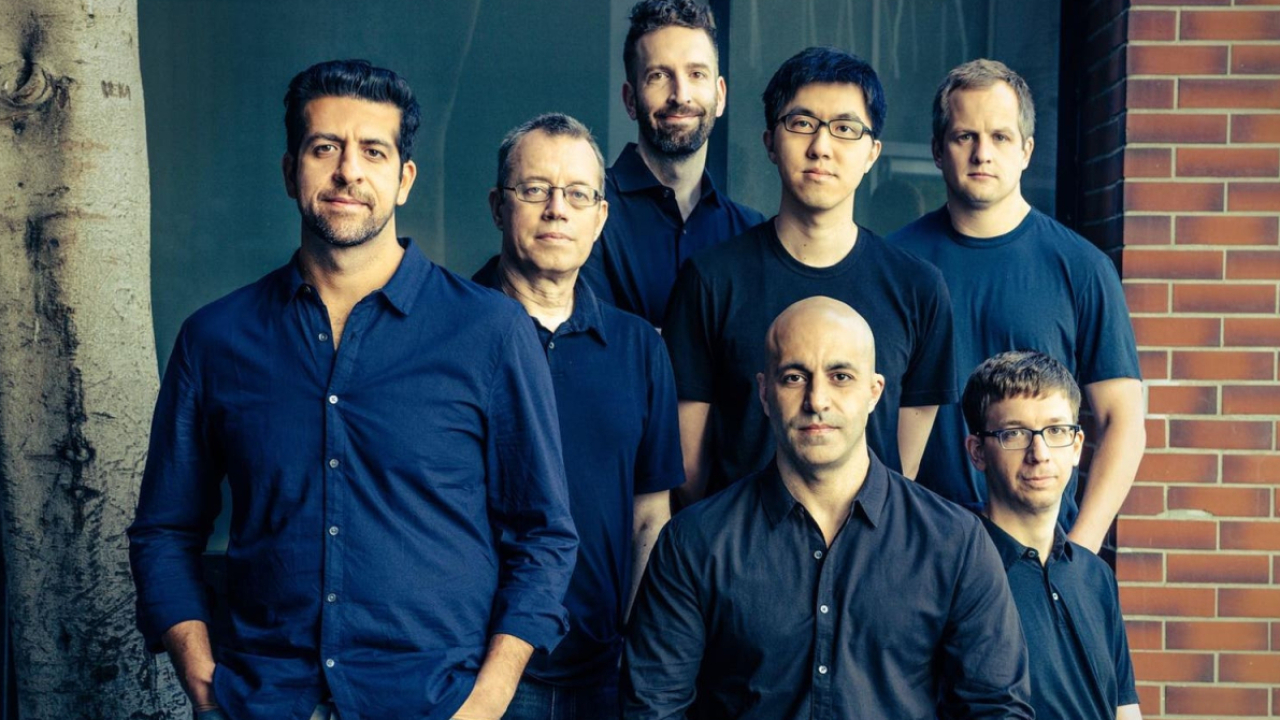

The team led by the partners – Tomasz Swieboda, Michał Rokosz and Maciej Małysz – has already backed over 30 companies, out of which 6 already have a valuation of over EUR 100 million. Inovo VC already participated in investment rounds led by notable funds, like a16z, Google’s Gradient Ventures, Insight Partners, Point Nine, or Tiger Global Management.

“We see an increasing interest of international investors in companies founded in the CEE countries. Two third of our portfolio companies managed to raise follow-on rounds with top-tier international VCs. We want to strengthen the links between the CEE region and the global VC ecosystem even more. So far, we have co-invested with over 70 international funds and we are convinced this number will grow at a fast pace”, says Maciej Małysz, Partner at Inovo VC.

The current portfolio of Inovo VC includes: AllSet –a pick-up or dine-in food marketplace operating in the US market, Archbee – a developers’ collaboration tool, Booksy – a SaaS-enabled marketplace for beauty services, Infermedica – an AI-powered technology for preliminary medical diagnosis and triage, Packhelp – a custom-made packaging producer, Preply – a global language learning marketplace, connecting tutors with students, Spacelift – a Terraform-compatible CI/CD platform for infra-as-code, Tidio – live chat, chatbot and mailing solutions for micro-businesses, and Zowie – a self-learning AI chatbot automating customer service for enterprise clients.

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

“Inovo was the first investor of Booksy and has been actively supporting us since then. Michał Rokosz even joined us as an interim COO for almost two years, helping the company grow its revenue sixfold and raise over USD 15 million from international venture capital firms. They have remained with us today and I still can call them for help even in the most extraordinary cases. Inovo is effectively a Swiss Army knife of VCs”, says Stefan Batory, Co-Founder and CEO of Booksy.

Through its capital investments and an active support of founders and their teams in growing startups and paving the way for later-stage funding from international investors, Inovo VC plays a significant role in the development of the Polish startup ecosystem.

Polish venture capital investments have seen a growth of 22,6x from 2018 to 2021, reaching a total value of EUR 792 million last year. The total value of VC investments in the first six months of 2022 in Poland is EUR 448 million, with 93 transactions involving 111 funds, according to the reports from PFR Ventures.

“Over the last 7 years we’ve seen the region growing at an exceptional pace, which results in the rise of the number of funding rounds and in an even faster rise of startup valuations at every stage of their development. We are sure that the CEE region will raise at least ten new unicorns in the upcoming 5 years. With our new fund we want to help make that happen”, says Tomasz Swieboda, partner at Inovo VC.

Oana Coșman

Oana Coșman