”The estimated transaction value in Q1-Q3 2022 shows a slight decrease compared to 2021 in Romania. This can be explained by the investors taking a more cautious approach to potential pre-seed and seed investments, but also to an existing portfolio”, says Alexandru Agatinei, CEO at How to Web.

”But there are many indicatitions that the venture market is approaching new hghts and a few transactions are in progress”, adds Alex.

Bogdan Iordache, founder at Underline Ventures, mentions in the report that „despite a relatively calm 2022, the Romanian tech scene has grown significantly in the last two years. The succes of UiPath has attracted the attention of many international investors and the Covid pandemic gave rise to many remote-first startups in which Romanian founders join US or UK cofounders”.

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

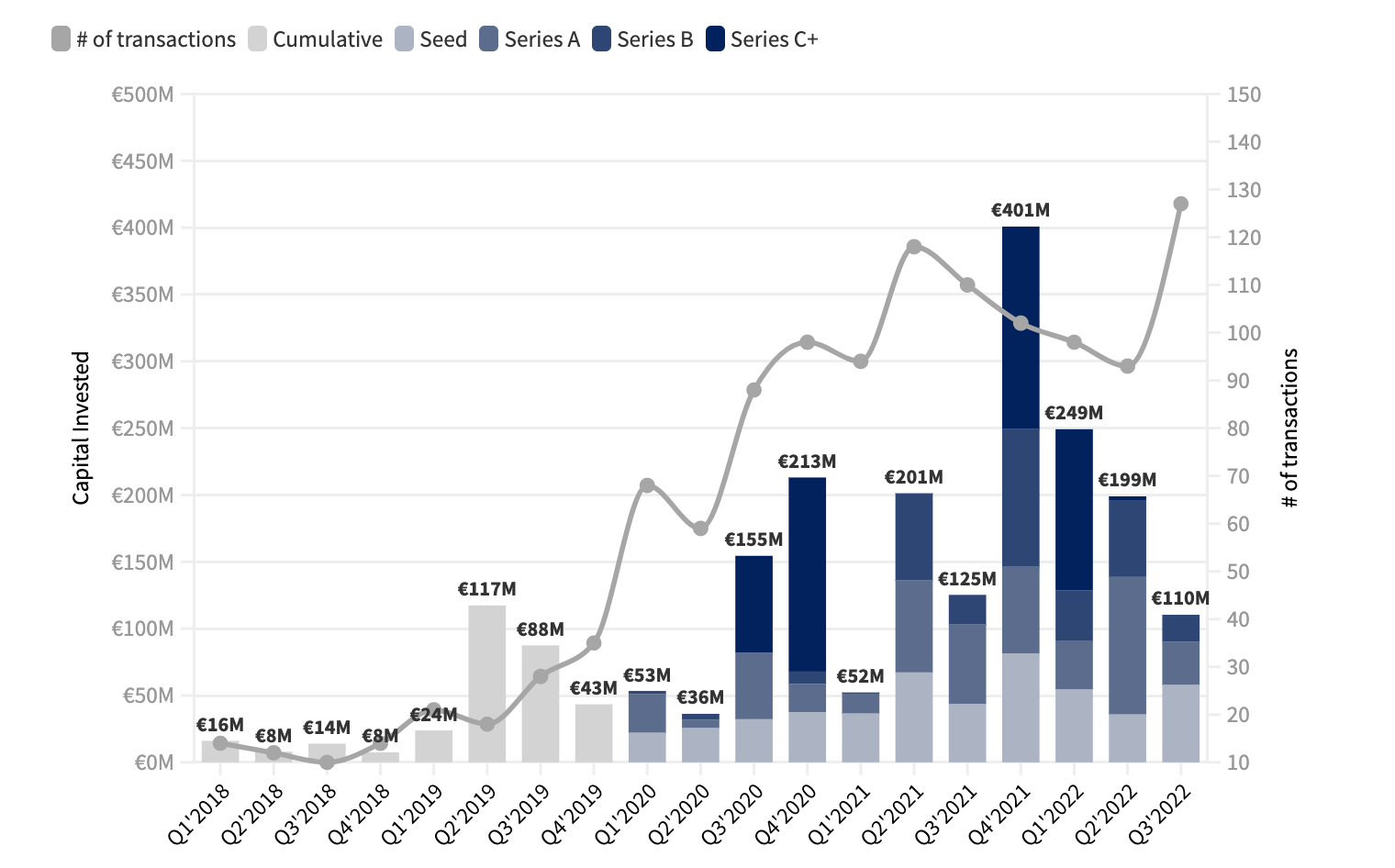

Polish venture capital investments have seen a growth of 22,6x from 2018 to 2021, reaching a total value of EUR 792 million last year. The total value of VC investments in the first six months of 2022 in Poland is EUR 448 million, with 93 transactions involving 111 funds, according to the reports from PFR Ventures.

According to the latest report by Inovo VC and PFR Ventures, in the last 3 months, over €110M (over PLN 0.5B) was invested in 127 Polish startups by 83 VC’s.

Although it may seem like a large sum, according to the data from Inovo, that is 12% less than in the corresponding period the year before and also less than the last quarter – almost twice (down from 199 million euros in Q2).

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

„The third quarter of the year is usually the least active time for VCs/fundraising also we’re living in a much more turbulent time than a year ago. Despite that, YTD 2022 is almost 50% higher than the previous year”, state the investors from Inovo in their report of the Polish VC landscape. You can find the entire report here.

The data also shows that 95% of the rounds raised by the Polish startups in the last quarter were pre-seed and seed, with a media amount of a transaction of 200,000 euros – there were 2 deals for 15 million euros (Sunroof and Nevomo), one for 6,7 million euros (RedStone), another one for 5 million euros (More Growth) and a round of 3,4 million euros (The Village).

Only 5 startups raised funds for Series A and just 2 for Series B rounds. At the same time, some of the top Polish funds have also been busy raising their own funds, so their deal-making capabilities were limited.

At the same time they announced their expansion to fund startups in the region and also in Romania, Inovo VC was also the first Polish venture capital firm to announce its third fund, following the success of the first two vehicles.

They had a total capitalisation of EUR 60 million for investments in the companies from the CEE region.

The first fund, in its exit phase, has already seen a 3x return of allocated capital. The second is still active, but only takes parts in the follow-on funding rounds of its existing investments.

The team led by the partners – Tomasz Swieboda, Michał Rokosz and Maciej Małysz – has already backed over 30 companies, out of which 6 already have a valuation of over EUR 100 million. Inovo VC already participated in investment rounds led by notable funds, like a16z, Google’s Gradient Ventures, Insight Partners, Point Nine, or Tiger Global Management.

The third fund will continue Inovo’s mission of identifying and nurturing outstanding founders of tech companies from the CEE region and supporting them in conquering international markets. It aims to invest in a total of 20-30 companies, with a single investment ticket ranging from EUR 500 up to EUR 4 million, from pre-seed to Series B rounds.

Regarding the last 3 months of the year, Polish investors are cautious and also mention the fact that Israel also saw a decline in the value of VC transactions by ~80%. From that perspective, Inovo’s almost 50% YTD growth looks very strong.

"We need about PLN 1 billion to break the record from 2021. Historically, our market has already recorded such levels of quarterly financing five times. This allows us to believe that despite the unfavorable economic and geopolitical conditions, the Polish ecosystem will maintain its upward trend. Most importantly, it will distinguish us from other regions where we are seeing large declines. We see this as a positive signal for foreign investors willing to operate in CEE", says Aleksander Mokrzycki, vice president at PFR Ventures.

Polish VC Market Outlook Q3 2022 by start-up.ro on Scribd

Oana Coșman

Oana Coșman