In this new article for founders who want to fund their startup with the help of investment funds or private investors, which we are creating with the help of the European co-investment platform SeedBlink, we will discuss topics such as how to prepare for a meeting with investors, how to negotiate and close a deal, and how to continue communicating with the people and institutions that have invested in your startup.

First of all, how do you prepare for a meeting with potential investors and what documents do you bring to a preliminary funding meeting?

What do investors want

There are a few things that every investor - regardless of the amount of money they can offer you - expects.

For example, a concrete plan outlining how you are going to get the startup from point A to point B, a concise pitch deck - the supporting presentation that can help you convince them - and proof that your product has traction - your startup's progress and the momentum it's gaining as it grows.

Depending on the stage of the company's development, you can talk about active users or, as your company has grown, monthly or annual recurring revenue (MRR or ARR).

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

Andrei Dănescu, Dexory | Cum au ajutat investițiile de 250 de milioane de dolari la implementarea de roboți în depozite

"During the presentation, it is important to be able to explain in a few words what your product does. A common mistake is to treat investors like customers and present your product as if you are trying to make a business. Investors are people who want to give you the fuel you need to turn the business plan into tangible results, and they expect transparency," representatives from the SeedBlink platform tell us.

Their advice for founders: know the important numbers for the startup and for the market in which it operates. Also, the estimates for the development should be as close to reality as possible and match the potential the startup has in the market segment it operates in.

What happens after the deal is signed

Once you have attracted the attention of investors and received a definite "yes" from them, negotiating and closing financing is a process that can depend on several factors on a case-by-case basis. For example, on the type of investing companies (angel investors, VCs).

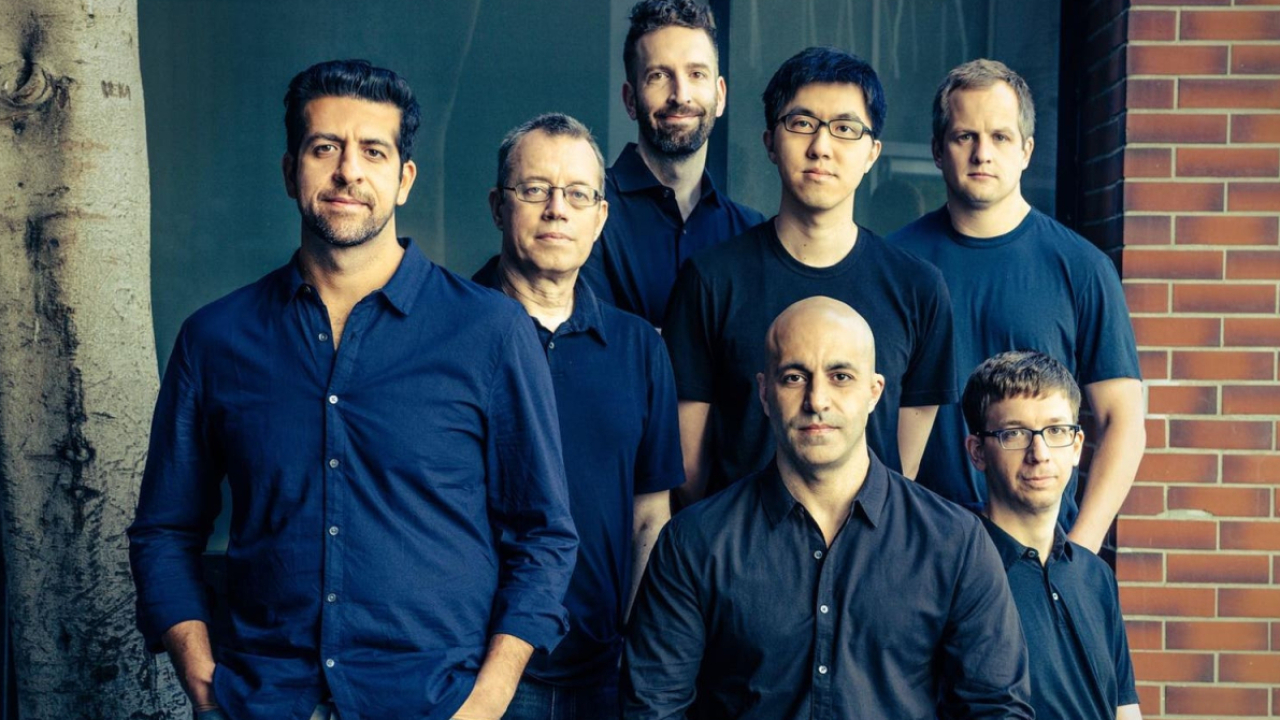

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Startup-ul creat de românii Ion Stoica și Matei Zaharia, Databricks, investiție la evaluare de 134 mld. $

Investment funds typically have a structure that they use in all deals and guide founders in closing an investment round, with all of these aspects captured in a term sheet that details the investment and subsequent structure.

"There are countless online resources that can help you with this process, and it is always advisable to hire an attorney to assist you with all legal aspects," recommends the SeedBlink team.

With investment platforms like SeedBlink, the entire process is streamlined and simplified as much as possible. "We have templates for each step to make the process as simple as possible, and we also take care of the legal part for the founders," the platform representatives told us.

Once you start talking to investors, your relationship with them is far from over.

With large sums of money at stake, every investor wants to follow up on what the founder has accomplished with the deck they came to the meetings with, and they want their investment to yield a return.

So as a founder who has received an investment, it is necessary to be as transparent as possible when communicating with investors, but without making communication with them a full-time job.

After all, you need time to do everything you set out to do to take your startup to the next level.

One of the best quotes I have received from an investor regarding the relationship with founders is, "The worst thing an investor can do is waste the founders' time and distract them from their goal - growing the company."

On the list of things to consider when maintaining relationships with investors after you have raised an investment are regular (monthly or quarterly) updates to investors. You need to prepare, in the most transparent way possible, information about the startup's development, milestones reached, problems encountered, and, very importantly, let investors know how they can help you move forward.

"As long as you clearly tell your investors where they can help, 9 times out of 10 they will tell you what they can and cannot do. As a founder, you determine how much help you accept from investors," added representatives of co-investment platform SeedBlink.

Oana Coșman

Oana Coșman